THE MoQ INDICATOR SUITE

Trade with structure, precision, and clarity — all in one place.

OUR CORE INDICATORS

MoQ MS/OB — your compact real-time market companion.

MomentumQ MS/OB is a charting indicator that highlights market structure, institutional order blocks, and fair value gaps across multiple timeframes. It includes gap/FVG scanners, key level overlays (daily/weekly/monthly highs and lows), and an auto Fibonacci tool. With customizable display controls, it helps you track important zones, structure breaks, retests, and higher-timeframe context for cleaner, more focused trading decisions.

MoQ Osci — a trusted partner for timing and direction.

MomentumQ Oscillator is an adaptive momentum and trend indicator that combines MACD with KAMA to highlight regime shifts and potential reversals. It normalizes output to a –100 to 100 range for consistent signals across markets and timeframes, adds configurable bands and alerts, and lets traders tune sensitivity, scaling, and triggers. Built to reduce noise on medium-to-long timeframes, it pairs well with your MS/OB and FVG tools for confluence.

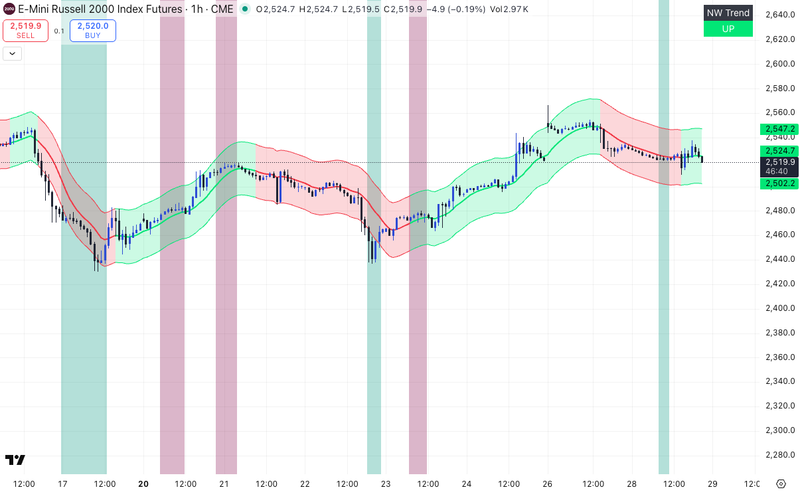

MoQ Sniper - your adaptive reversal radar

MoQ Sniper is an all-in-one indicator that combines trend, reversal, and volatility into a single, clean view. It uses a normalized MA Reversal metric, Price Countdown for exhaustion, and a Nadaraya–Watson Envelope for overbought/oversold zones. With clear color signals, real-time alerts, and deep customization, it helps spot reversals, momentum shifts, and mean-reversion setups across scalping to swing trading without clutter.

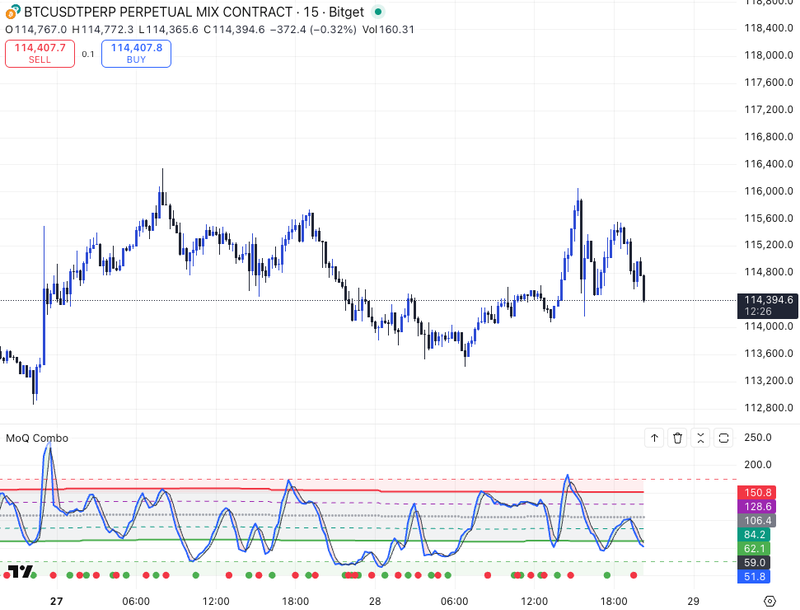

MoQ Combo - your momentum regime radar

MomentumQ Combo blends RSI and Stochastic RSI to show momentum regime shifts and overbought/oversold zones with clear, color-coded visuals. It includes automatic divergence detection, Light/Dark Mode, and an optional Momentum Tracker with enhanced %K/%D logic for spotting momentum bias and transitions at a glance.

MoQ Dash - your timeframe and correlation grid

MomentumQ Dash is a multi-timeframe, multi-asset dashboard that displays MomentumQ Oscillator signals in two tables: one for several timeframes of the current symbol and one for a watchlist of assets. It shows bullish/bearish regime, buy/sell and pre-signals, plus how recent each signal is. V2.0 adds an optional Risk ON/OFF overlay using VIX or a custom driver for quick macro context.

Documentations

MomentumQ MS/OB is an advanced all-in-one Smart Money Concepts (SMC) toolkit for TradingView. It automatically detects and visualizes Order Blocks, Fair Value Gaps (FVGs), price gaps, key highs/lows, and Fibonacci levels — across multiple timeframes. This indicator is designed to help traders map liquidity, structure, and institutional price zones in real time, without clutter or manual drawing. Use it to visually identify demand/supply areas, imbalances, and reaction points across all timeframes.

Read MoreThe MomentumQ Oscillator (MoQ Osci) is an adaptive momentum and regime analysis tool designed to help traders identify potential reversal zones, continuation risk, and exhaustion points with high clarity.

Read MoreMomentumQ Sniper is an advanced multi-signal and trend-modeling toolkit for TradingView. It combines adaptive smoothing (Nadaraya-Watson envelopes), moving average structure, price countdown setups, regression channels, and volatility bands in a single overlay. The indicator provides a clear picture of market context, directional bias, and potential exhaustion or breakout zones — without requiring manual calculations or multiple scripts.

Read MoreThe MomentumQ Combo (MoQ Combo) is an adaptive momentum and regime analysis toolkit that blends classical RSI logic, Stochastic RSI timing, divergence mapping, and an advanced Momentum Tracker engine. Its goal is simple: help you understand where momentum is right now, how extreme it is, and whether it’s starting to flip — without guessing.

Read More14 Days of Full Access — On Us

Before signing up, please review our Privacy Policy, Terms of Use, and Disclaimer.