Version: V4.2

License: Mozilla Public License 2.0

Author: © MomentumQ

1. Overview

MomentumQ MS/OB is a professional TradingView indicator designed to simplify Smart Money Concepts (SMC) analysis.

It automatically detects and visualizes Order Blocks, Fair Value Gaps (FVGs), price gaps, and key market levels — helping traders interpret structure, liquidity, and potential reaction zones in real time.

Core Features

- ✅ Order Block detection (bullish & bearish)

- ✅ Fair Value Gap (FVG) scanner with automatic extension

- ✅ Price Gap detection with auto-fill tracking

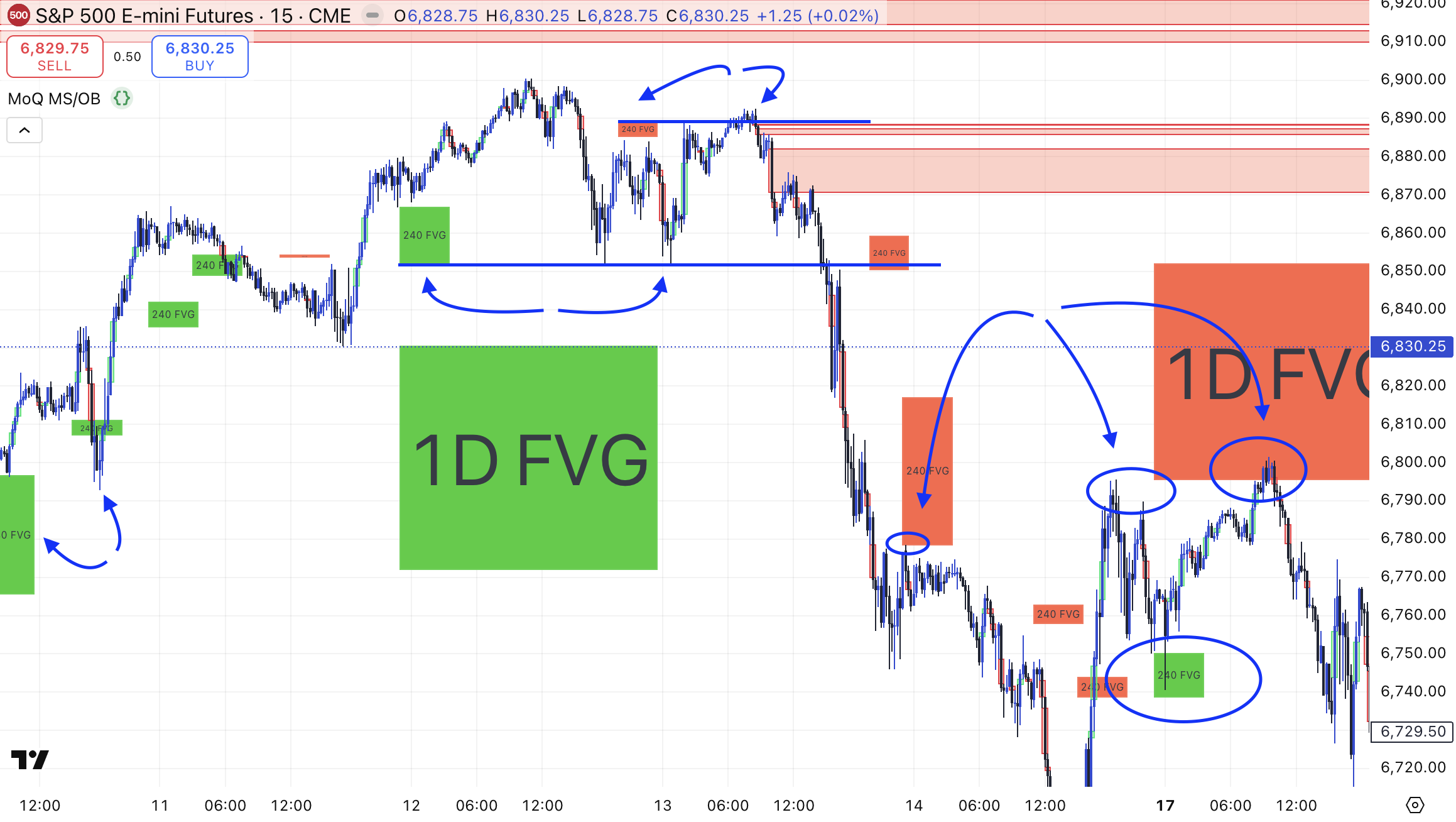

- ✅ Multi-timeframe zones (see HTF structure inside LTF charts)

- ✅ Previous Day / Week / Month levels

- ✅ Auto Fibonacci retracements & extensions

- ✅ Dark & Light mode support

💡 This tool does not generate buy/sell signals. It visualizes market structure and liquidity concepts to assist discretionary traders.

2. Display Modes & Appearance

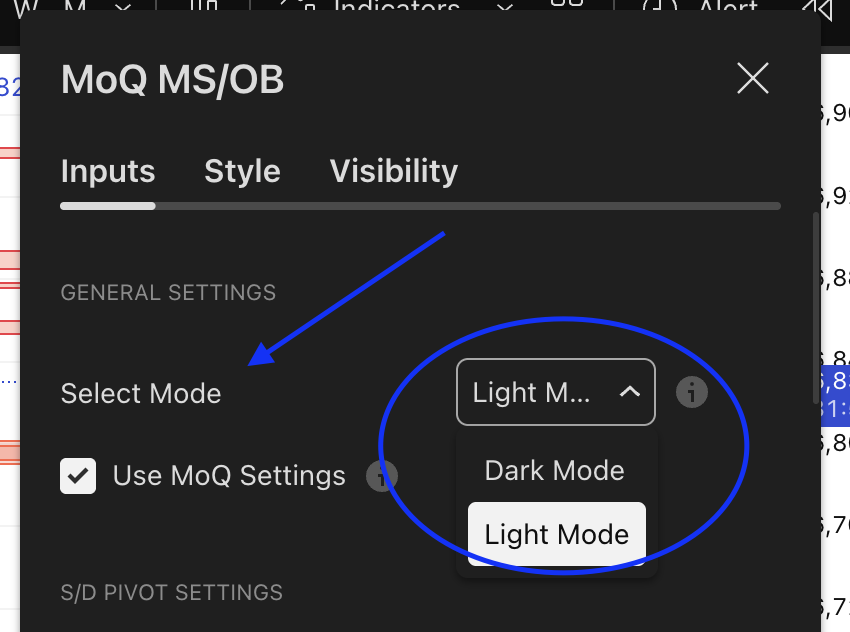

Dark Mode / Light Mode

This setting adjusts text and line colors for optimal readability.

Choose between Dark Mode and Light Mode to match your TradingView theme.

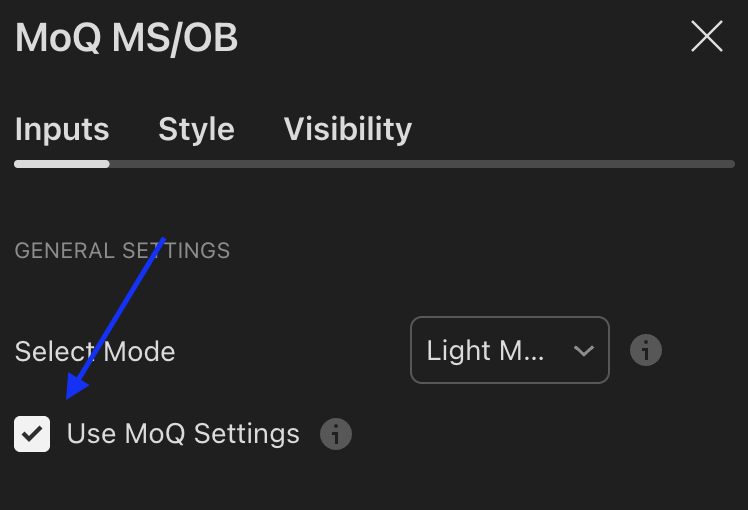

Use MoQ Settings

Enable “Use MoQ Settings” to apply MomentumQ’s default style configuration (standardized colors and transparencies).

Disable it to fully customize all color settings manually.

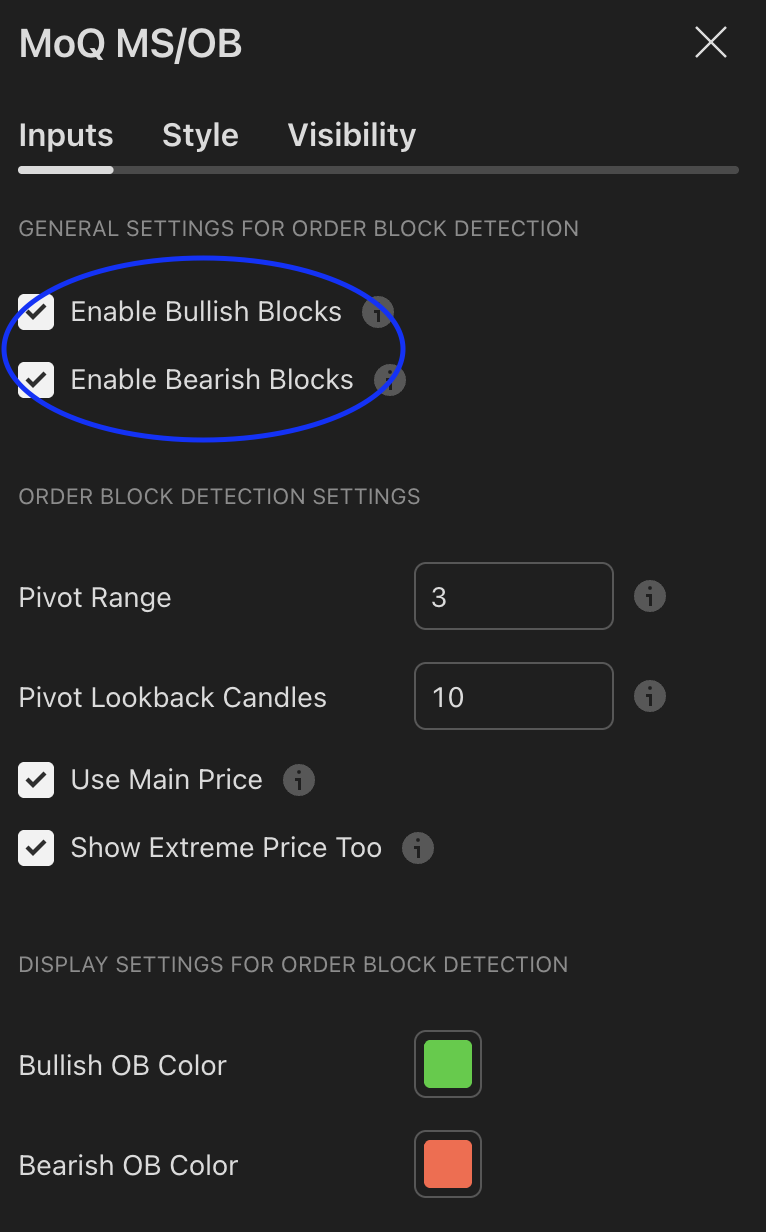

3. Order Blocks

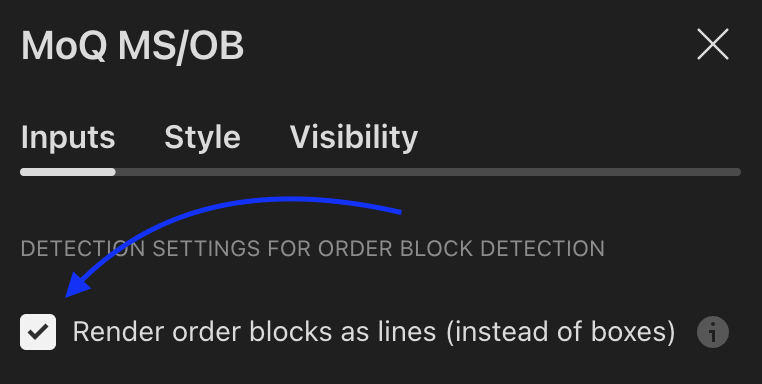

To enable automatic order block detection, click on the checkboxes as shown below:

What They Represent

- Bullish Order Block: Last bearish candle before a bullish impulse.

- Bearish Order Block: Last bullish candle before a bearish impulse.

These areas often mark institutional demand (support) or supply (resistance) zones.

Visualization

- Bullish zones → green boxes

- Bearish zones → red boxes

- Boxes extend rightward as long as the zone remains active.

Zone Deactivation

- Bearish OB → becomes inactive if price closes above its top.

- Bullish OB → becomes inactive if price closes below its bottom.

Once invalidated, the box remains as historical context but stops extending.

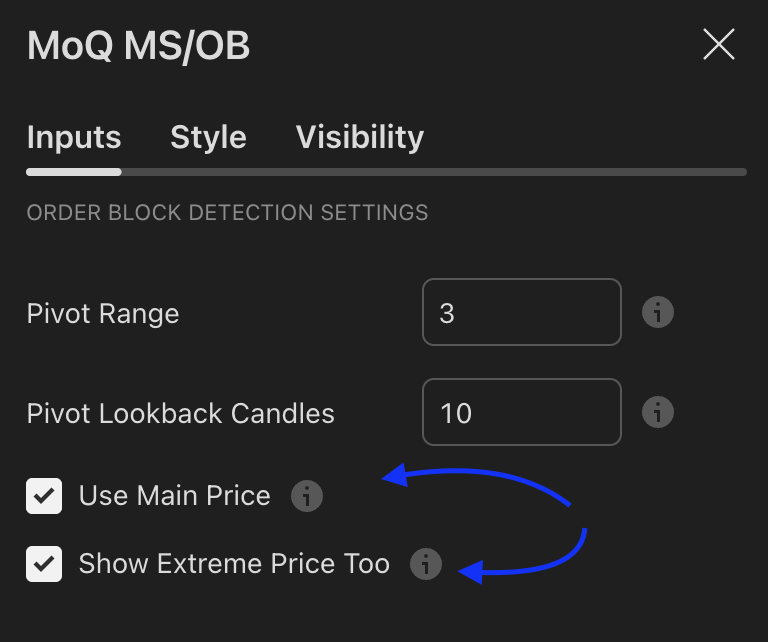

Main Price vs. Extreme Price

- Main Price: Uses candle body (open/close) for refined OB range.

- Extreme Price: Uses full wick (high/low) for broader coverage.

You can display both simultaneously for more context.

Render Options

You can toggle:

- Boxes: filled areas (default)

- Lines: top/bottom boundaries only (minimalist view)

Each style can be separately customized for bullish and bearish blocks.

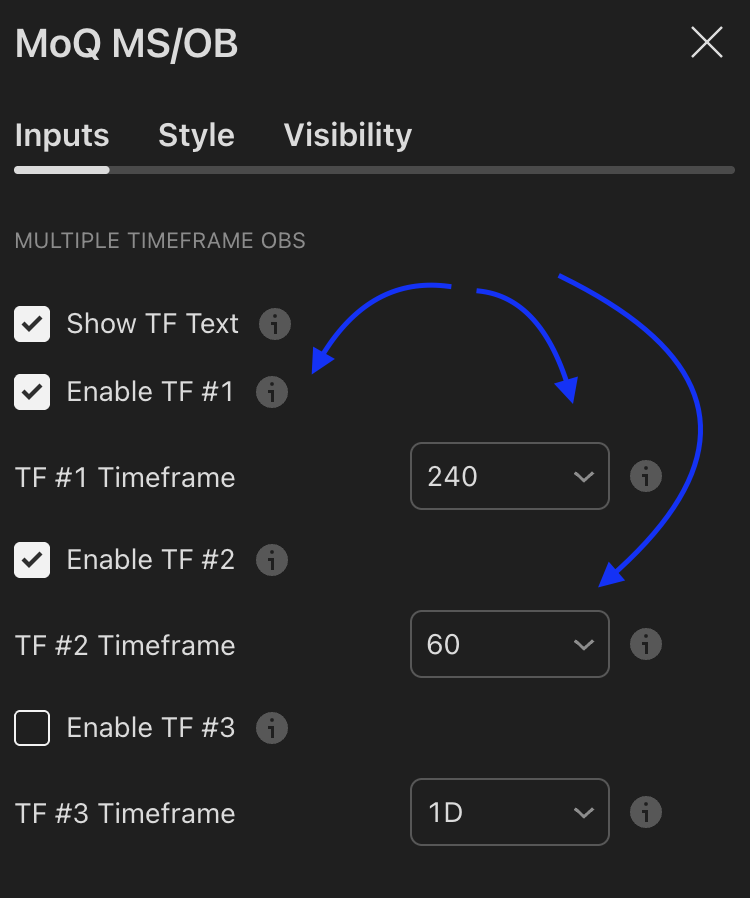

4. Multi-Timeframe Order Blocks

MomentumQ MS/OB supports up to three higher-timeframe overlays.

Example: view 4H and 1h Order Blocks directly within a 15-minute chart.

Each timeframe has its own enable toggle and label.

This helps identify confluences between intraday structure and higher timeframe zones — a key principle in SMC trading.

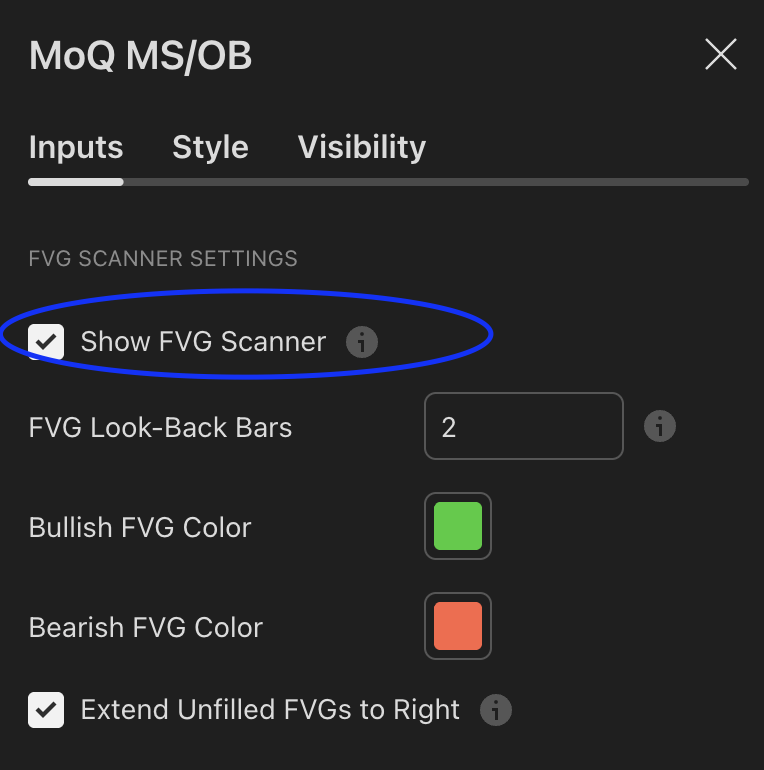

5. Fair Value Gaps (FVGs)

Definition

An FVG (Fair Value Gap) is an inefficiency created when price moves so rapidly that it leaves untraded space between candles.

Detection Logic

- Bullish FVG: High of candle n < Low of candle n+2

- Bearish FVG: Low of candle n > High of candle n+2

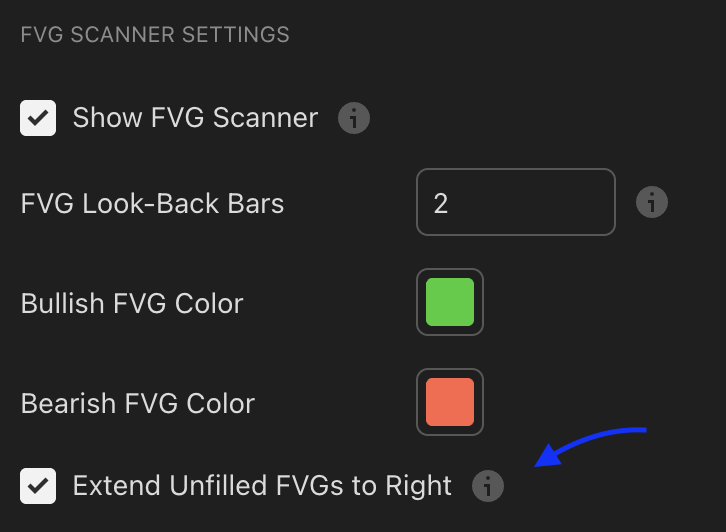

Auto-Extension

Enable “Extend Unfilled FVGs to Right” to visually track live, unfilled imbalances.

When price fills an FVG (touches its opposite boundary), the box stops extending automatically.

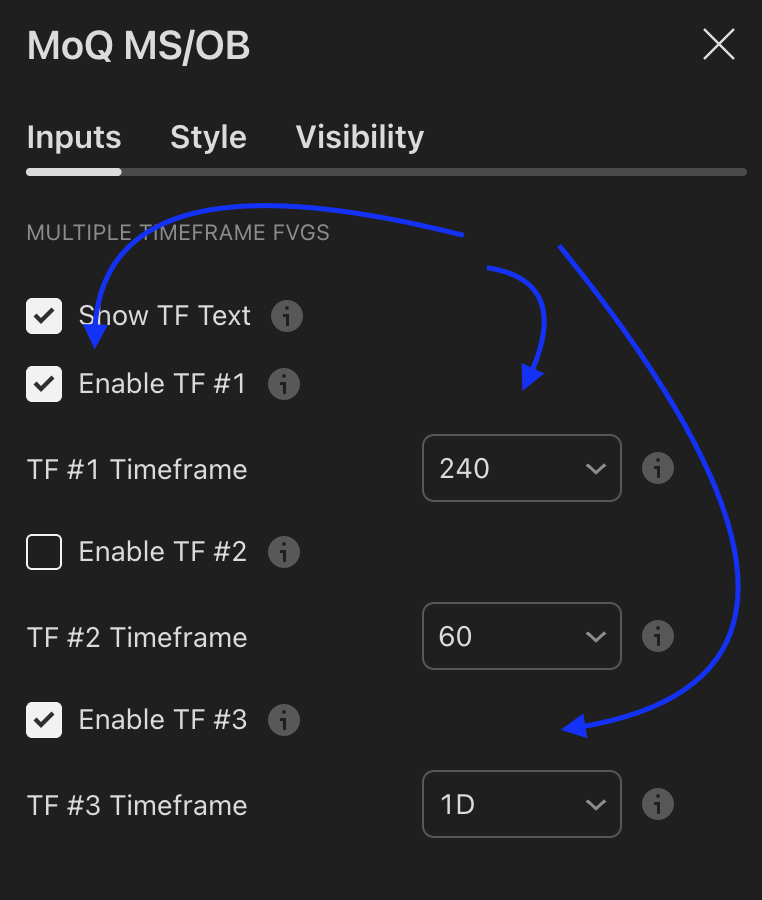

Multi-Timeframe FVGs

Display up to 3 higher-timeframe FVGs (e.g., “4H FVG” or “1D FVG”) on your current chart.

Each FVG is labeled by timeframe for clarity.

6. Price Gap Scanner

The Gap Scanner identifies opening gaps between consecutive candles.

Logic

- Bullish gap: Current open > previous high and low > previous high

- Bearish gap: Current open < previous low and high < previous low

Visualization

Each gap is drawn as a box that extends rightward until filled.

When price returns into the gap zone, it stops extending automatically.This helps traders quickly identify unfinished price business or liquidity voids.

7. Key Levels

MomentumQ MS/OB can display major reference levels:

- Previous Day, Week, and Month Highs and Lows

These are critical for spotting:

- Liquidity sweeps

- Range boundaries

- Potential reversal areas

Each can be toggled on/off individually.

8. Auto Fibonacci Levels

Function

Automatically plots Fibonacci retracements and extensions between the most recent confirmed swing high and swing low.

Features

- Standard retracements (0.236 → 1.0)

- Optional extensions (1.272, 1.618, 2.0)

- Dynamic updates when new swings form

- Optional ratio labels

- Fully customizable colors, widths, and visibility

This replaces manual fib drawing and updates automatically as market structure evolves.

9. Line Aging / Cleanup

For order block boundary lines, you can define an automatic removal time in months (1–12).

Old lines are deleted after expiry to keep your chart clean.

Visual boxes remain intact for historical reference.

10. Recommended Workflow

- Identify Bias

- Use higher timeframe order blocks and FVGs to define directional bias.

- Mark Liquidity Zones

- Observe previous day/week/month highs and lows.

- Watch for sweeps and rejections.

- Execution

- Wait for price to reach an active OB, FVG, or gap.

- Monitor lower-timeframe reaction and structure shift.

- Targets

- Use unfilled FVGs, gaps, or Fibonacci extensions as logical targets.

⚠️ This tool supports analysis. It is not a trading signal system and does not provide financial advice.

11. Best Practices

- After updating to a new version, remove and re-add the indicator to reload new settings.

- Choose your preferred visual mode before customizing colors.

- For scalping or intraday use:

- Enable higher-timeframe zones (e.g., 1H / 4H)

- Enable FVG & Gap extension

- Turn on Previous Day Levels

- For higher timeframe analysis:

- Disable smaller tools (like gap extension) for a cleaner view.

12. Legal Disclaimer

Important Notice

This indicator and its associated documentation are provided for educational and informational purposes only.

It does not constitute financial advice, trading recommendations, or an offer to buy or sell any financial instrument.All trading involves risk. You are solely responsible for your investment decisions and should consult a licensed financial advisor before acting on any analysis.The MomentumQ MS/OB script and all related materials are licensed under the Mozilla Public License 2.0.

Redistribution or modification must comply with that license.© MomentumQ. All rights reserved.