Version: V4.1

License: Mozilla Public License 2.0

Author: © MomentumQ

1. Overview

MomentumQ Sniper integrates multiple quantitative and technical modules into one visual framework.

It’s designed for professional and discretionary traders who want a complete bias and structure map directly on their chart.

Core Features

- 🟢 Nadaraya-Watson Envelopes – adaptive smoothing + dynamic trend channel

- 🟣 Price Countdown Setups – automatic 9-bar exhaustion detection

- 🔵 Moving Average Signals – normalized distance-based turning points

- 🟡 Customizable Moving Averages Stack – short- to long-term structure view

- 🧩 OLS Regression Line – quick trend estimation

- 🔴 Bollinger Bands Module – optional classic volatility view

- ⚙️ Dark / Light Mode Support

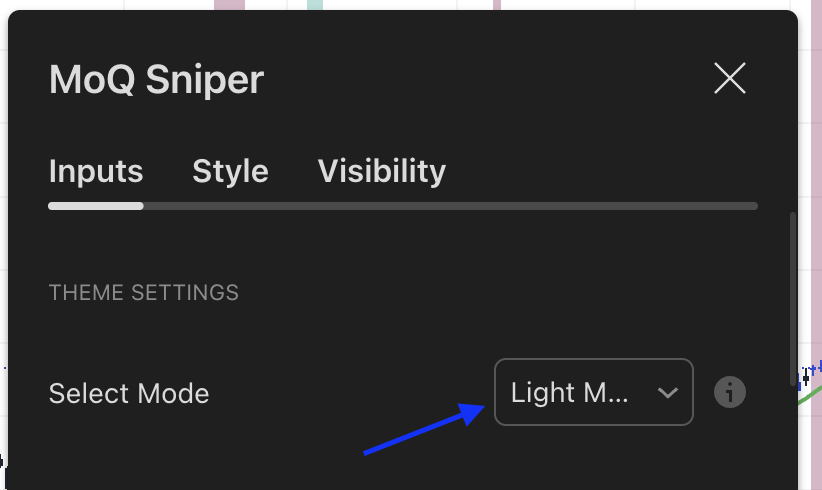

2. Theme Settings

Dark / Light Mode

Choose between Dark Mode or Light Mode to match your TradingView background.

All text, labels, and signal colors adjust automatically for clarity.

3. Moving Average Signal Engine

Function

This module measures how far price is from its Simple Moving Average (SMA) over a defined period (default = 50 bars) and normalizes that distance to identify potential momentum rotations.

Signals

- Bullish (B) – price recovering from below its mean (potential upturn)

- Bearish (S) – price retreating from above its mean (potential downturn)

These labels can be toggled with “Show MA Signals.”

They act as contextual momentum markers — not guaranteed entry/exit signals.

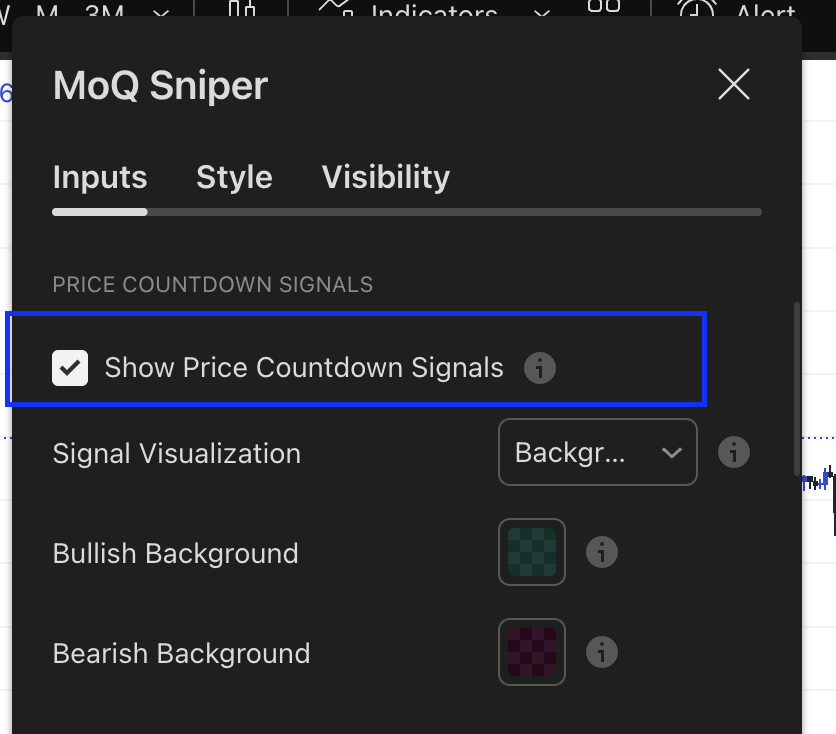

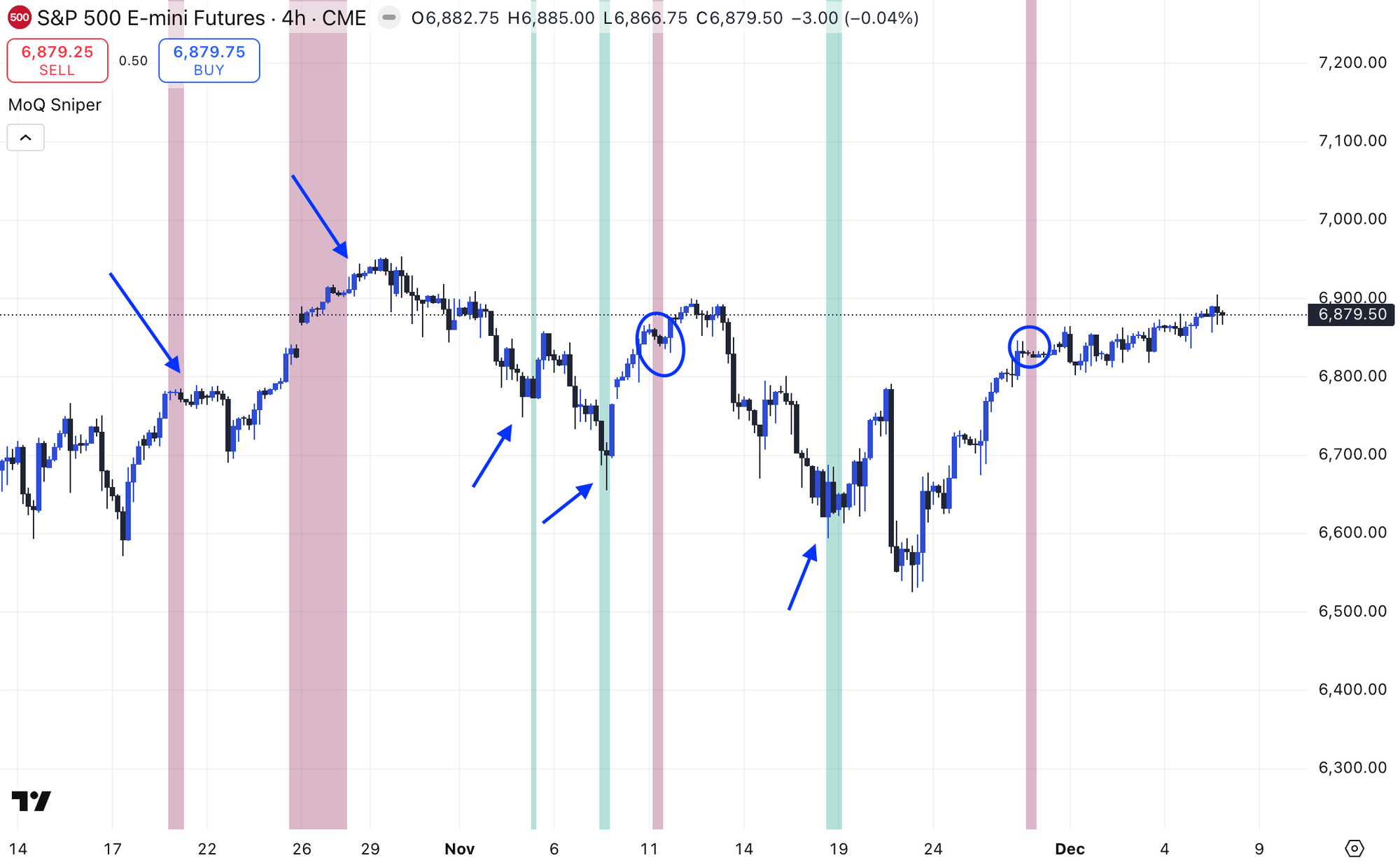

4. Price Countdown Setups

Inspired by quantitative exhaustion logic, this module counts sequences of directional closes.

Conditions

- Bullish Setup: Price closes below the close 4 bars ago for 9 consecutive bars.

- Bearish Setup: Price closes above the close 4 bars ago for 9 consecutive bars.

When such a streak completes, the bar is highlighted.

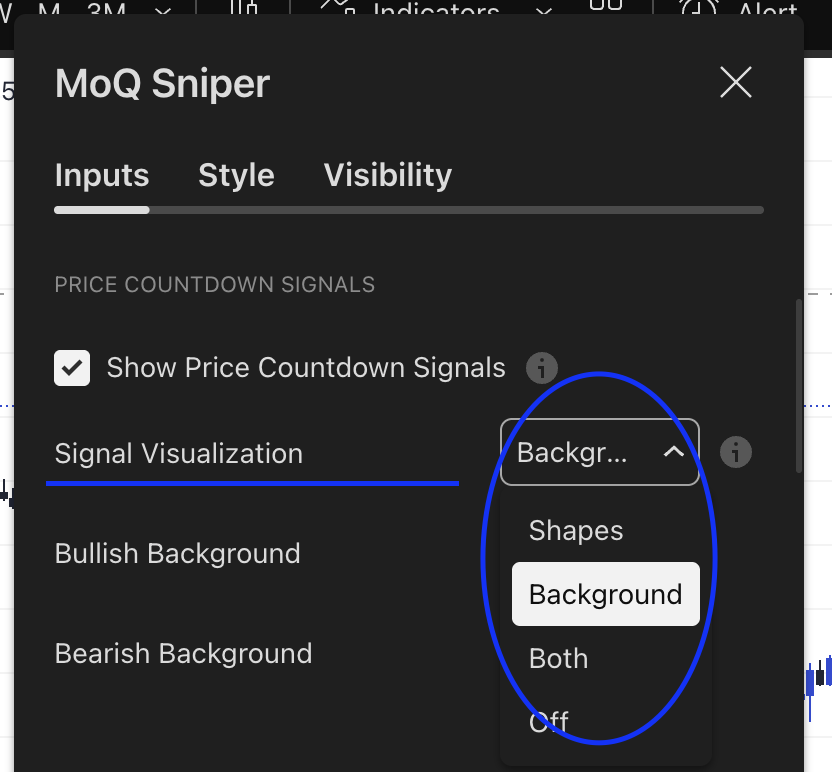

Visualization Modes

- Shapes – markers (+ or –) above/below bars

- Background – subtle background color

- Both – display both shapes and background

- Off – hide the module

Background:

Custom background colors (bullish / bearish) are user-defined.

Shapes:

This helps you instantly spot exhaustion clusters that may precede reversals.

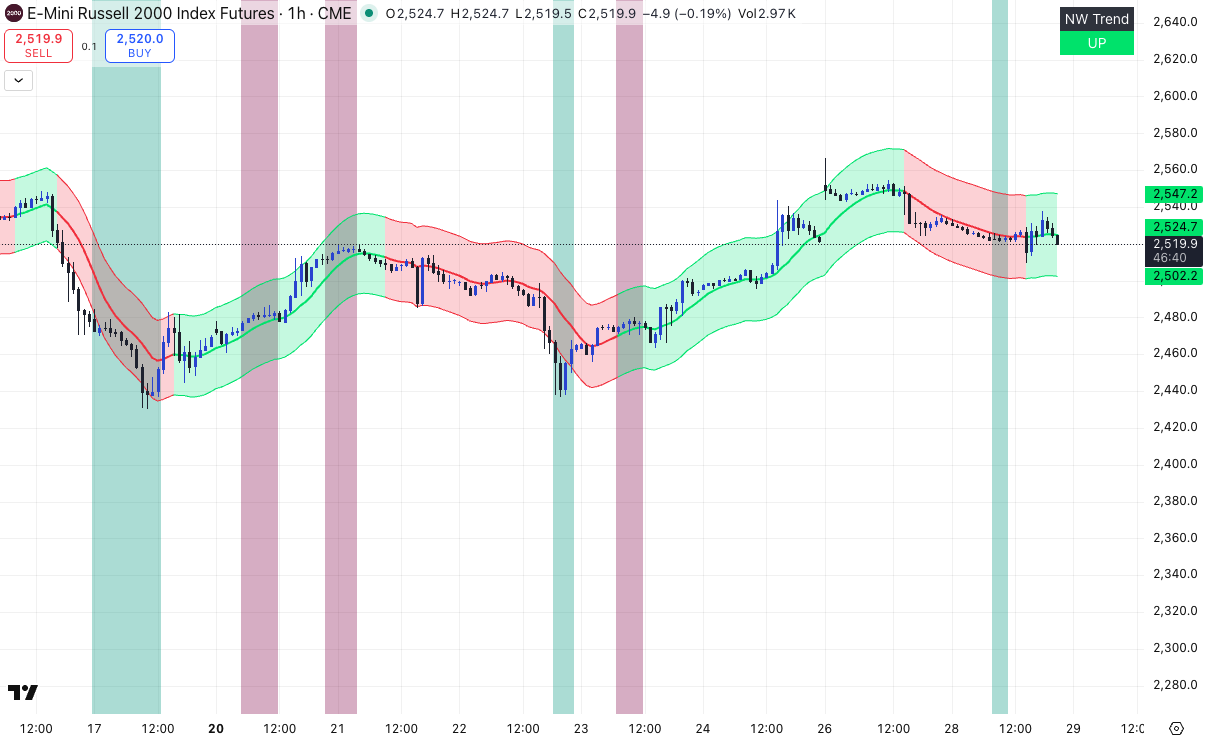

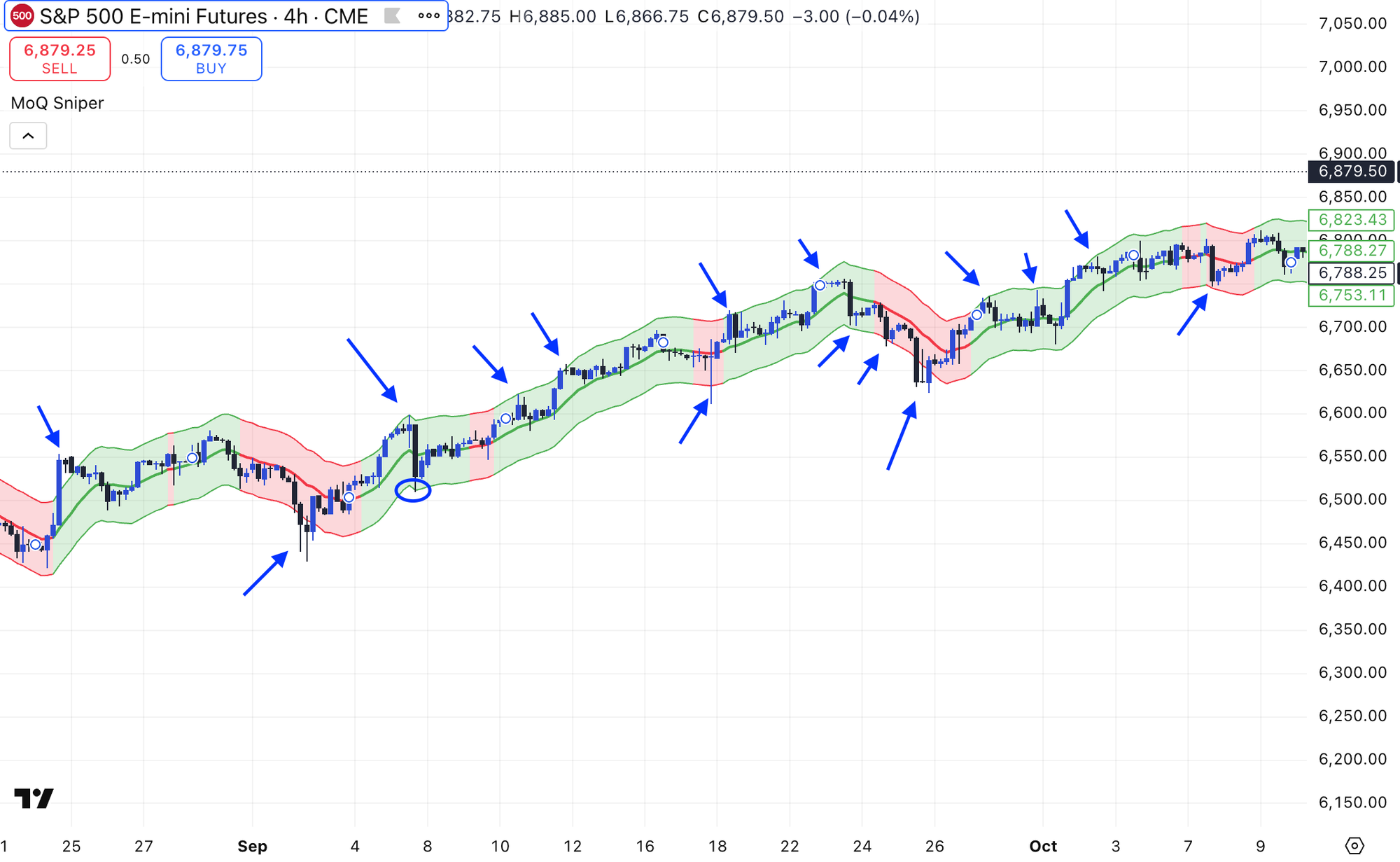

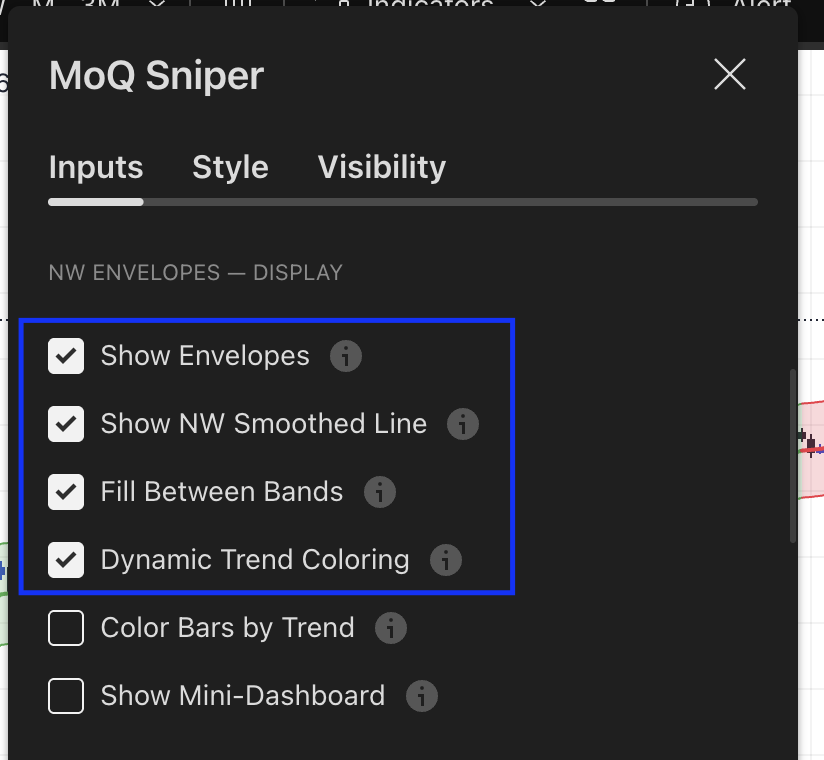

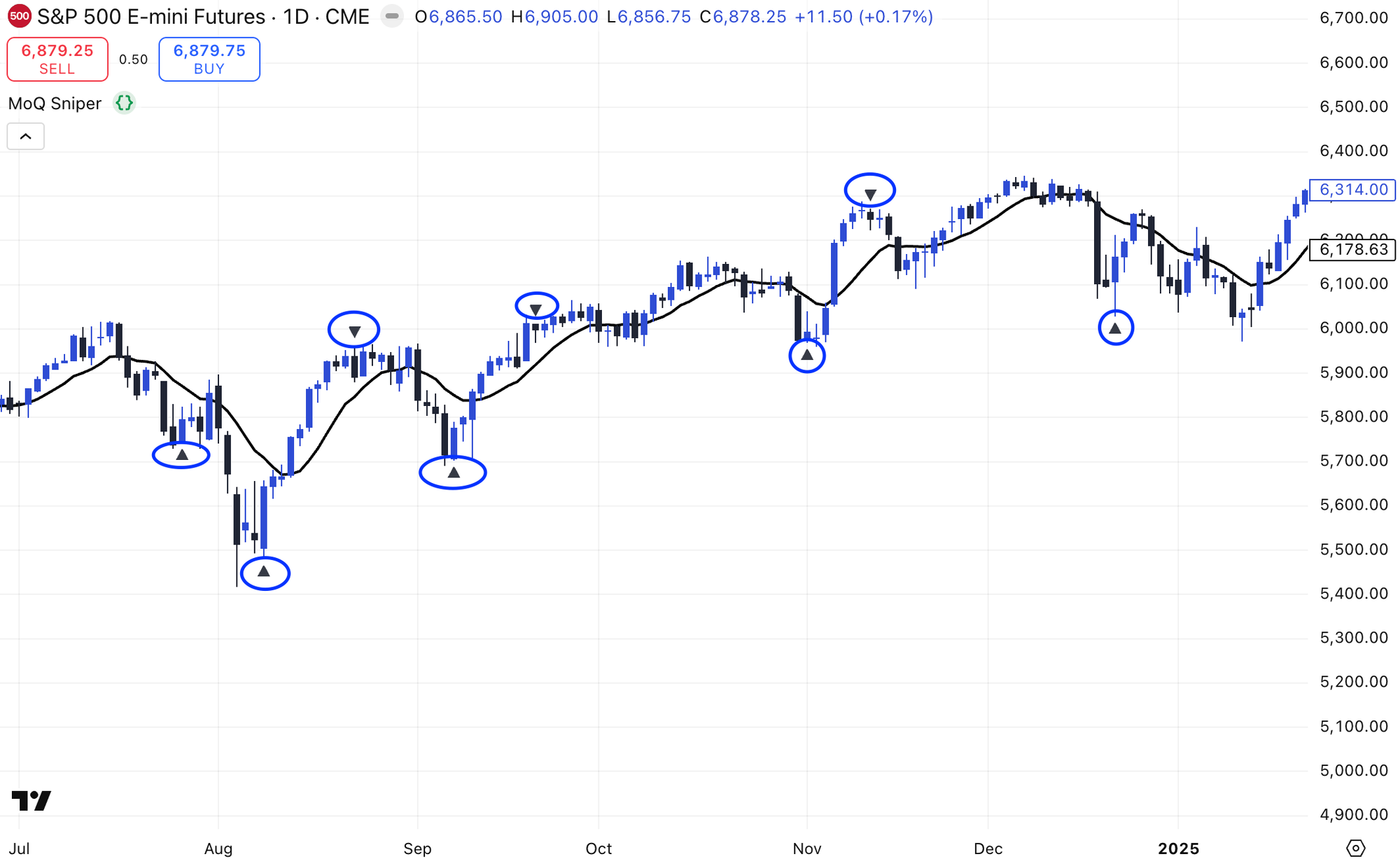

5. Nadaraya-Watson Envelopes (Trend Model)

The core of Sniper.

It applies a Nadaraya-Watson kernel regression to smooth price and draws adaptive envelopes based on volatility.

Example:

Main Components

- Smoothed NW Line – fair-value estimate of price

- Upper and Lower Envelopes – dynamic overbought/oversold zones

- Fill Between Bands – optional shaded trend channel

- Dynamic Trend Coloring – slope-based (lime = up, red = down)

- Bar Re-Coloring (Optional) – color candles by NW trend

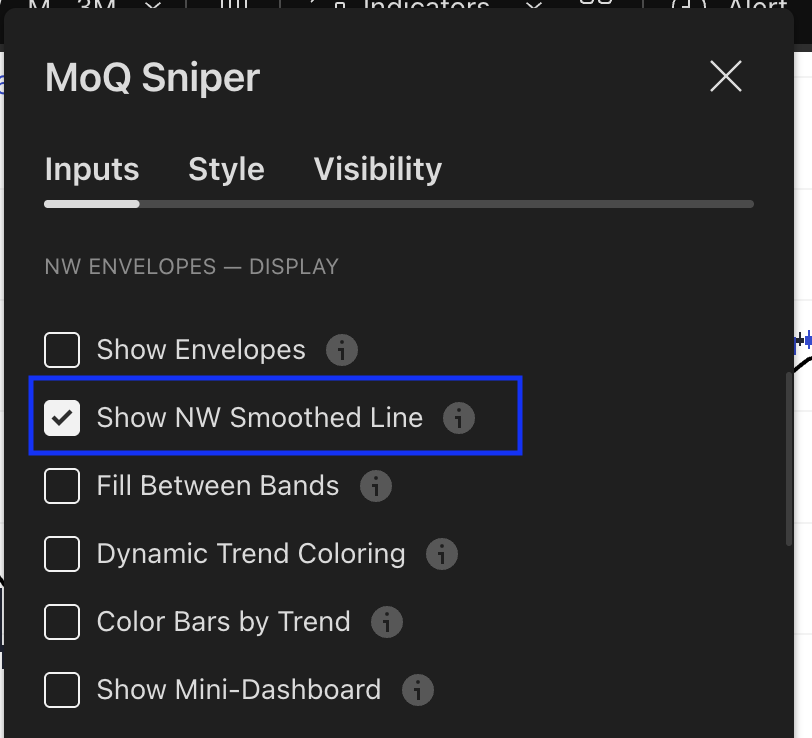

1. Smoothed NW Line

Settings:

Example:

2. Upper and Lower Envelopes

Settings:

Example:

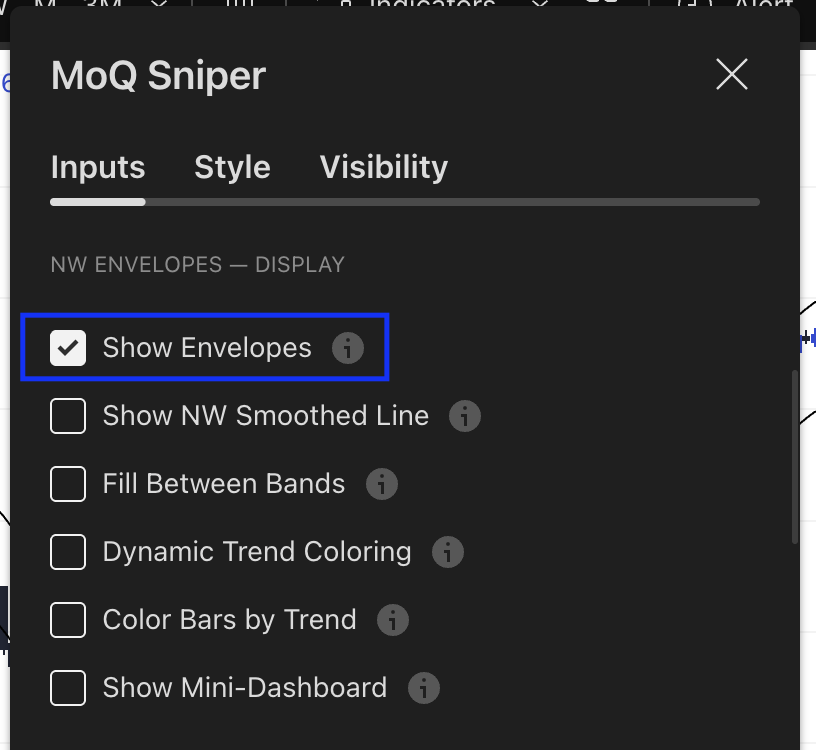

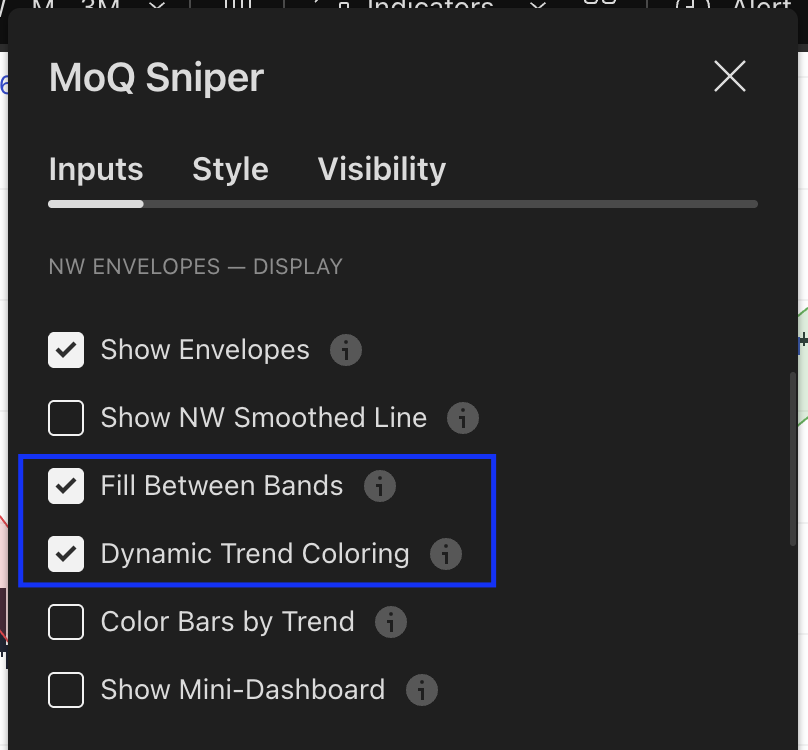

3 & 4. Fill Between Bands & Dynamic Trend Coloring

Settings:

Example:

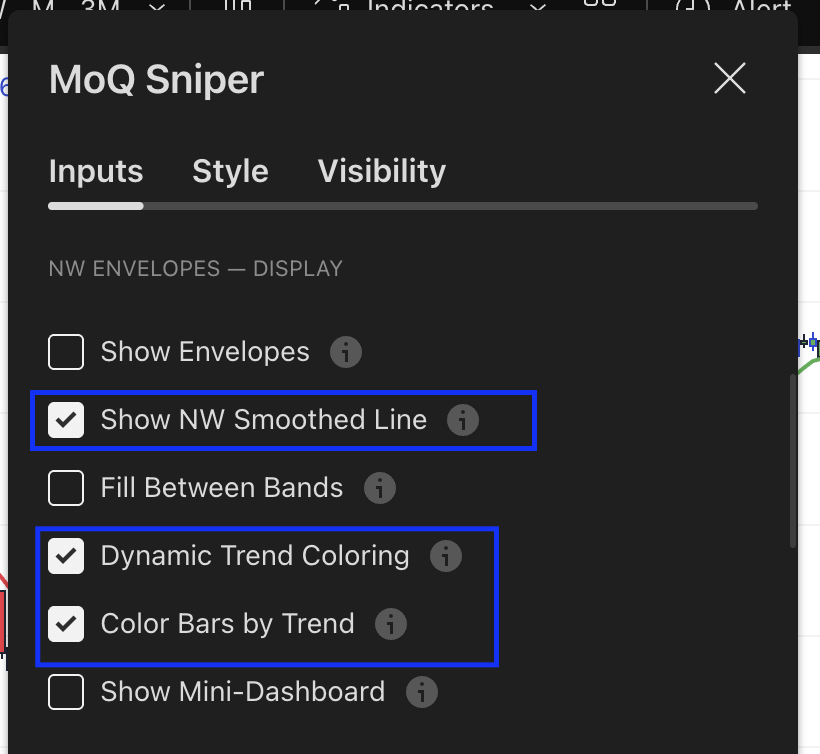

5. Bar Re-Coloring

Settings:

Example:

Adaptive Bandwidth

The smoothing reacts to volatility using ATR or Standard Deviation.

When volatility rises, the bandwidth expands; when it contracts, smoothing tightens.

You can control:

- Adapt Mode: ATR or StdDev

- Adapt Strength: sensitivity

- Adapt Lookback: period for baseline

Higher Timeframe Mode

You can compute the entire NW model using a higher timeframe source (e.g., 4H data on a 15m chart).

This produces a higher-level directional channel useful for lower-timeframe execution.

Mini-Dashboard

A small table (top-right corner) displays:

- “UP” = positive slope

- “DOWN” = negative slope

This quick visual cue gives you instant trend bias.

6. NW Signals (Alerts & Markers)

When “Show Signals” is enabled, Sniper can mark events derived from the NW envelopes.

Modes

- Reversal Mode – price touches the outer envelope (potential reaction)

- Breakout Mode – price breaks through the envelope (potential continuation)

Reversal:

Breakout:

Alerts

Two built-in alert conditions:

- NW Long Signal – bullish touch or breakout

- NW Short Signal – bearish touch or breakout

You can attach TradingView alerts to receive notifications in real time.

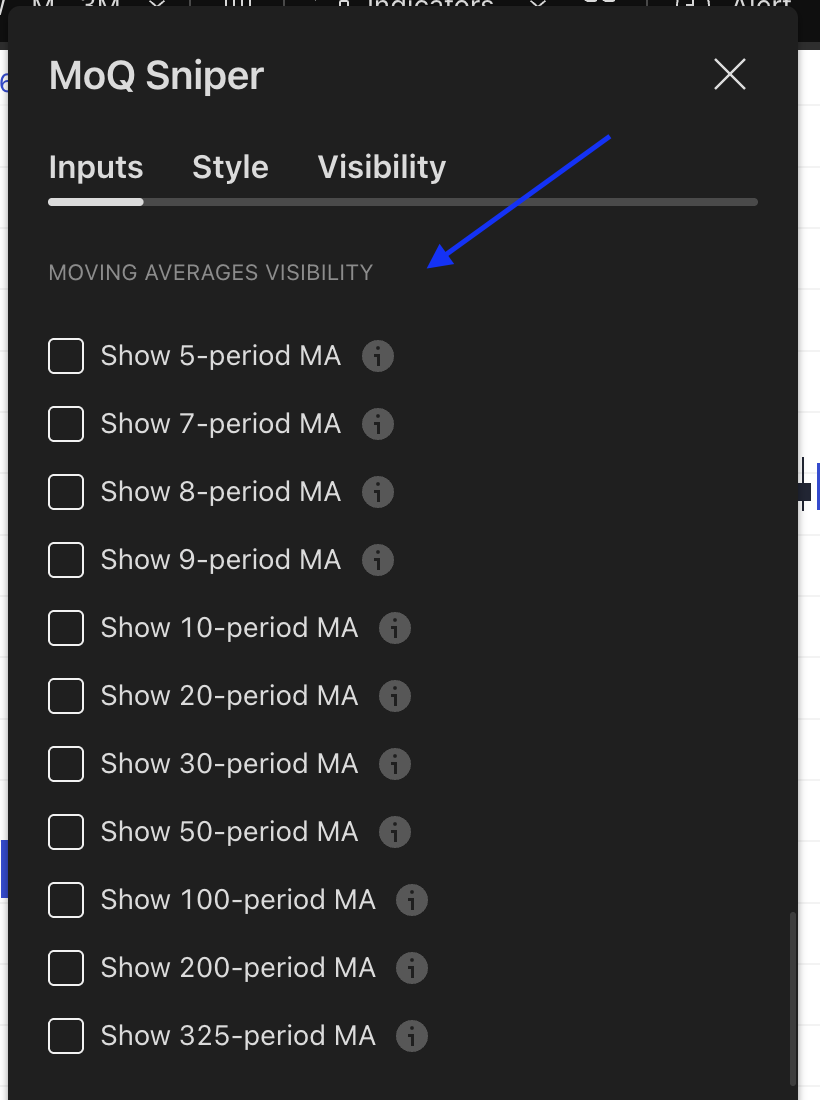

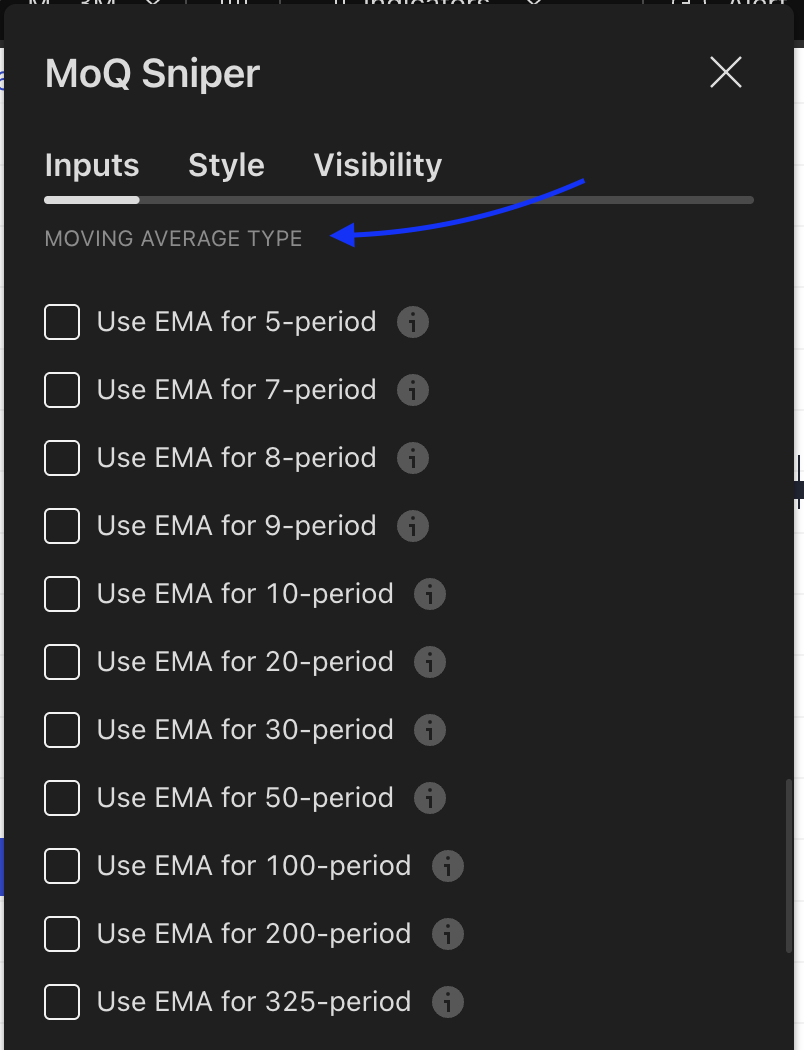

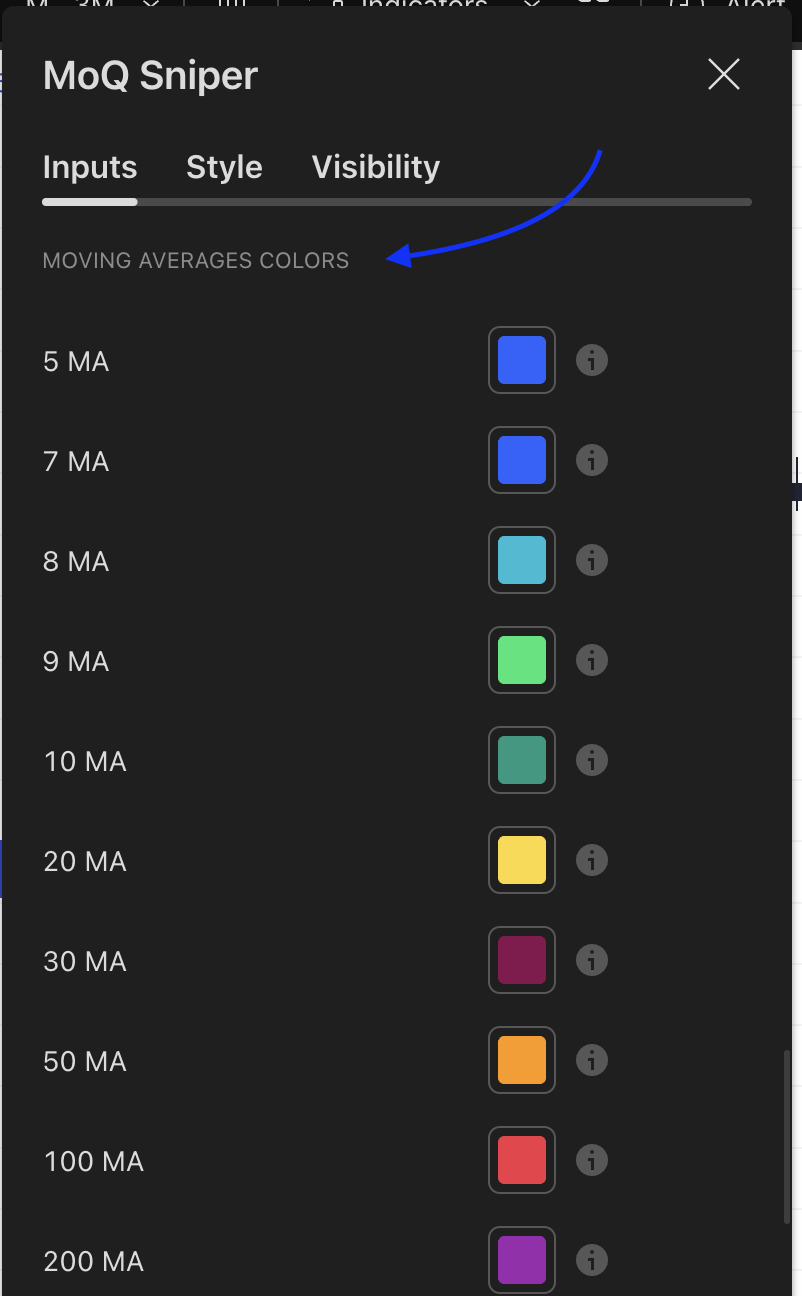

7. Moving Averages Stack

A flexible framework of multiple MAs (5 → 325 periods) with individual visibility and type selection.

Configuration

For each period you can choose:

- SMA or EMA

- Custom color

- Show/hide toggle

SMA Settings:

EMA Settings:

Color Settings:

Common use cases:

- Short-term (5-10) → micro trend and momentum

- Mid-term (20-50) → structure bias

- Long-term (100-325) → macro direction

Example:

This helps visualize structural alignment (bullish stack vs bearish stack) at a glance.

8. OLS Regression Line

The Ordinary Least Squares (OLS) Regression module fits a linear trend line over a selected number of bars (default 15).

Options

- Show Regression Line – displays current slope

- Show Intercept Line – displays baseline level

Purpose:

- Measure near-term direction and strength.

- Detect acceleration or deceleration phases.

9. Bollinger Bands Module

An optional overlay for traditional 20-period SMA ± 2 standard deviations.When enabled:

- Draws upper and lower bands.

- Optional color fill for quick volatility context.

This is a familiar complement to the adaptive NW model — allowing comparison between static and adaptive volatility zones.

10. Alerts Summary

Built-in alert conditions:

- Bullish Price Countdown – possible upward momentum

- Bearish Price Countdown – possible downward momentum

- NW Long Signal / Short Signal – interaction with envelopes

These alerts are optional and purely informational.

11. Best Practices

- After each update, remove and re-add the indicator to load new settings.

- Choose Dark / Light Mode first for consistent colors.

- For scalping or intraday trading:

- Enable NW Envelopes + Adaptive Bandwidth.

- Enable Price Countdown.

- Use short MAs (8–30).

- For swing or positional work:

- Focus on higher timeframe NW trend and long MAs (50–325).

- Disable extra signals for clarity.

12. Legal Disclaimer

Important Notice

The MomentumQ Sniper indicator and this documentation are provided for educational and informational purposes only.

They do not constitute financial advice, investment recommendations, or an offer to buy or sell any financial instrument.Trading involves substantial risk. Past performance is not indicative of future results.

Users are solely responsible for their own decisions and should consult a licensed financial advisor before acting on any analysis.The MomentumQ Sniper script is licensed under the Mozilla Public License 2.0.

Redistribution or modification must comply with that license.© MomentumQ. All rights reserved.