Version: V2.0

License: Mozilla Public License 2.0

Author: © MomentumQ

1. What MomentumQ Dash Does

MomentumQ Dash is built to answer three questions instantly:

- “What is the current directional bias (Bull or Bear)?”

- “Is there an actionable setup forming right now, or did it already fire?”

- “Is risk sentiment supportive or hostile across correlated markets?”

Instead of flipping charts, lower → higher TF, SPX → VIX → oil → BTC, you get that entire situational picture in two clean tables on your current chart.You see:

- Regime (Bull / Bear)

- Confirmed Buy / Sell triggers

- Pre-Buy / Pre-Sell warnings (early setups forming)

- ‘Upper Limit’ / ‘Lower Limit’ pressure zones

- How many candles ago the most recent event occurred

This gives you bias alignment and timing context at a glance.

2. The Timeframe Table (Multi-Timeframe View)

The Timeframe Table analyzes the current chart symbol (for example, BTCUSD or ES1!) across up to five user-selected timeframes (e.g. 5m, 15m, 45m, 1h, 4h).For each timeframe, the table shows:

- B (Buy)

A bullish reversal trigger. The oscillator is signaling that downside pressure may have exhausted and bullish momentum is engaging. - S (Sell)

A bearish reversal trigger. The oscillator is signaling that upside pressure may have exhausted and bearish momentum is engaging. - PB / PS (Pre-Buy / Pre-Sell)

Early warning states:- PB (Pre-Buy): Price is approaching an early bullish setup zone, but hasn’t fully confirmed yet.

- PS (Pre-Sell): Price is approaching an early bearish setup zone, but hasn’t fully confirmed yet.

- LL / UL (Lower Limit / Upper Limit)

LL = price is pressing the lower boundary of its adaptive band.

UL = price is pressing the upper boundary of its adaptive band.

These zones often align with exhaustion, stalling, or potential fade points. - Trend (Bull / Bear)

The directional regime for that timeframe.- Bull means upward bias / positive momentum pressure.

- Bear means downward bias / negative momentum pressure.

- Last

Shows the most recent event (for example,PB (2)orB (0)), along with how many bars ago it occurred.B (0)means a Buy trigger just fired on the current bar.S (5)means a Sell trigger happened 5 bars ago.UL (1)means we touched the upper limit 1 bar ago.

Why this table matters

This table lets you align lower timeframe entry conditions with higher timeframe bias.

Example:

- 15m and 1h both in Bear regime and showing PS / S → avoid longs.

- 5m flashing PB while 1h and 4h are Bull → possible long scalp in direction of higher timeframe trend.

3. The Watchlist Table (Multi-Asset View)

The Watchlist Table lets you track up to five custom symbols on a single chosen timeframe.For example:

- SPX

- NDX

- VIX

- Oil

- Gold

You choose:

- Which symbols to track

- Which timeframe to evaluate them on (e.g. 1h)

For each symbol in the watchlist, the table shows the same columns as in the Timeframe Table:

- B / S

- PB / PS / LL / UL

- Trend (Bull / Bear)

- Last (latest event + bars ago)

Symbols are automatically cleaned for display (exchange prefixes like BINANCE: or NYSE: are removed where possible for a shorter label).

Why this table matters

This gives you instant correlation context and macro feel:

- Are equity indices firing Sell while VIX is in risk-on or risk-off mode?

- Is Oil flipping Bear while Gold is showing Buy?

- Are crypto majors aligned or diverging?

You don’t need to open five charts. You read one panel.

4. Signal Logic (Powered by MoQ Osci)

All table values are derived from the MomentumQ Oscillator (MoQ Osci), MomentumQ’s proprietary engine that measures momentum relative to an adaptive mean and adaptive bands.

The core states:

- B (Buy)

Bullish reversal trigger. Often appears when price pushes into lower pressure and then turns up. - S (Sell)

Bearish reversal trigger. Often appears when price pushes into upper pressure and then turns down. - PB (Pre-Buy)

The oscillator is telling you: “We are entering bullish pressure, but not fully confirmed yet.”

This can mark early accumulation before reversal. - PS (Pre-Sell)

Mirror of PB on the bearish side: “We are starting to lean bearish but it hasn’t fully broken yet.” - LL (Lower Limit)

Price is pressing the lower envelope / lower band area.

Often means: extreme downside stretch / possible support test. - UL (Upper Limit)

Price is pressing the upper envelope / upper band area.

Often means: extreme upside stretch / potential exhaustion. - Trend (Bull / Bear)

A simplified directional regime based on where current momentum sits relative to its adaptive mean and band midline.

Bull = positive directional pressure.

Bear = negative directional pressure. - Last

The freshest event, with age in bars.

This prevents you from reacting to something that happened 18 candles ago and is already stale.

Why this matters

You are not just getting “buy / sell” alerts.

You’re getting:

- Directional bias (Trend)

- Maturity (Last + bars ago)

- Pre-conditions (PB / PS)

- Pressure zones (LL / UL)

This is information, not just noise.

5. Risk Regime Overlays (Optional Module)

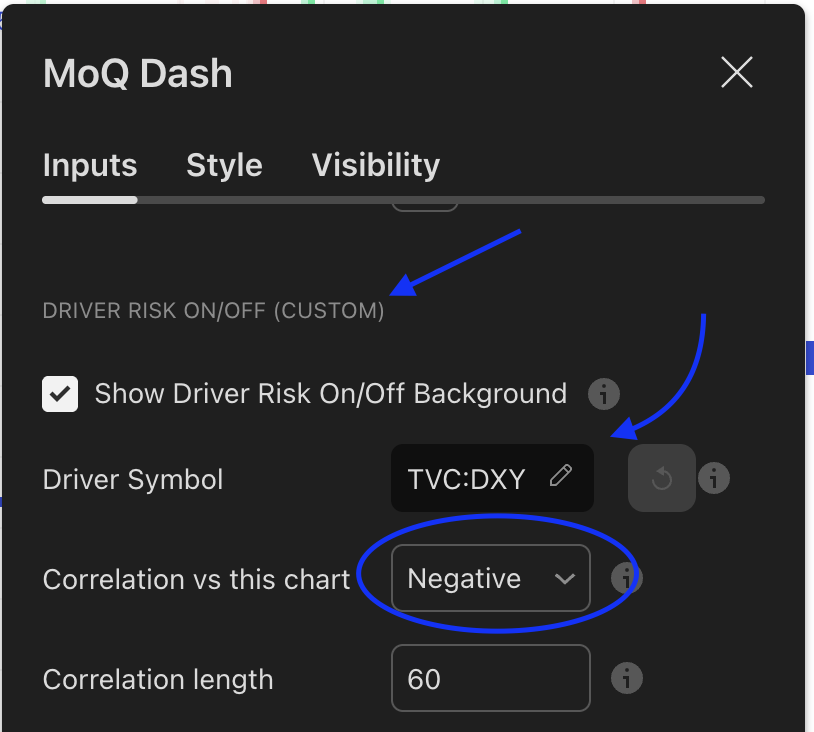

MomentumQ Dash can optionally overlay a background color on your chart to show Risk ON / Risk OFF conditions, using a macro driver such as VIX or any symbol you choose (for example DXY).

How it works:

- The same MoQ Osci logic is applied to the driver (VIX, DXY, etc.).

- The script classifies the environment into high-priority states:

- Strong (highest conviction)

- Pre (early warning)

- Flip (possible turn forming)

- The background is tinted green-ish for risk-on or red-ish for risk-off.

An example of using VIX as a signal deliverer:

There is correlation awareness:

- You can define whether the driver is normally positively or negatively correlated to your chart, or let the indicator auto-detect correlation.

- The color can auto-invert so the regime makes sense for the instrument you are actually trading.

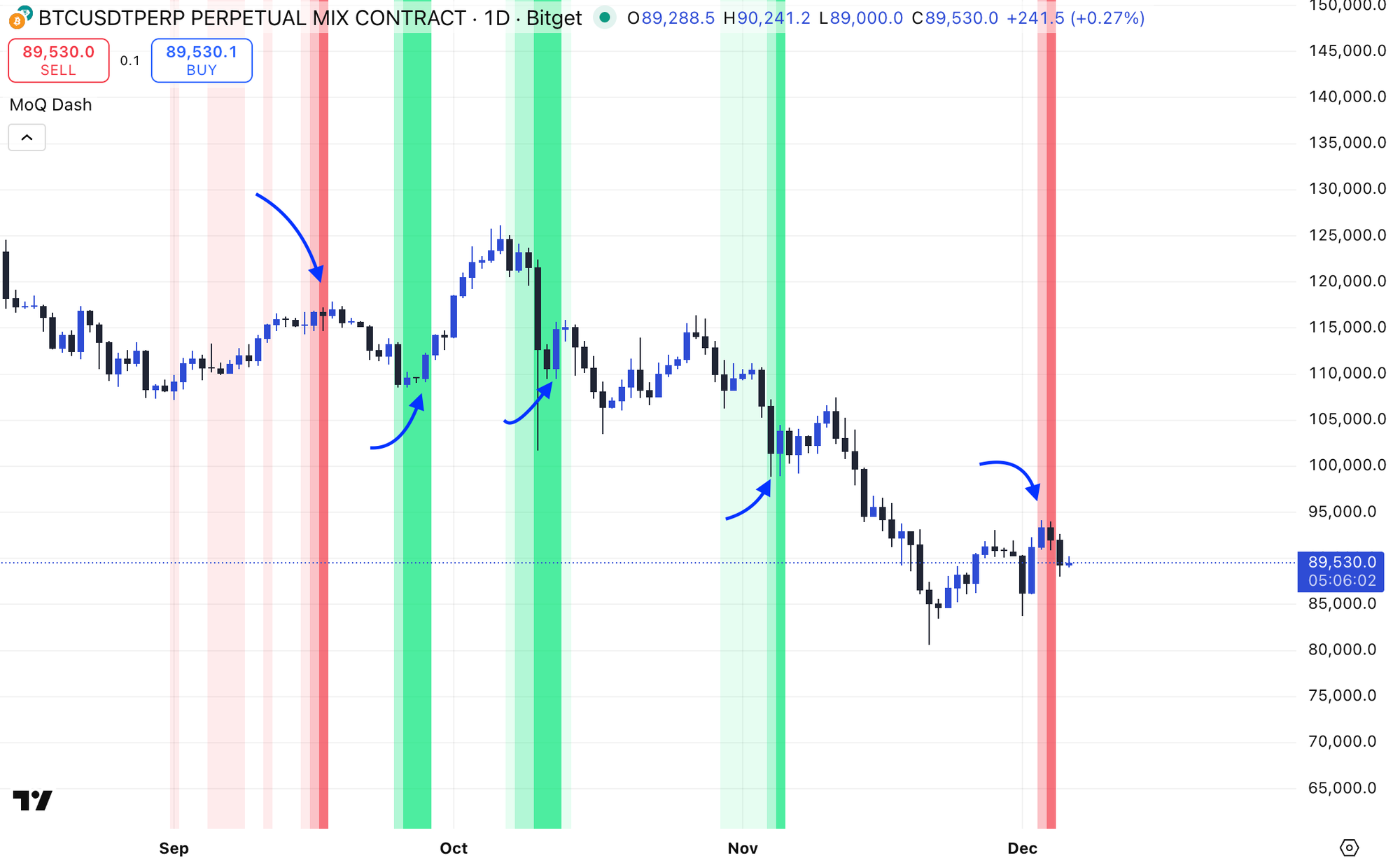

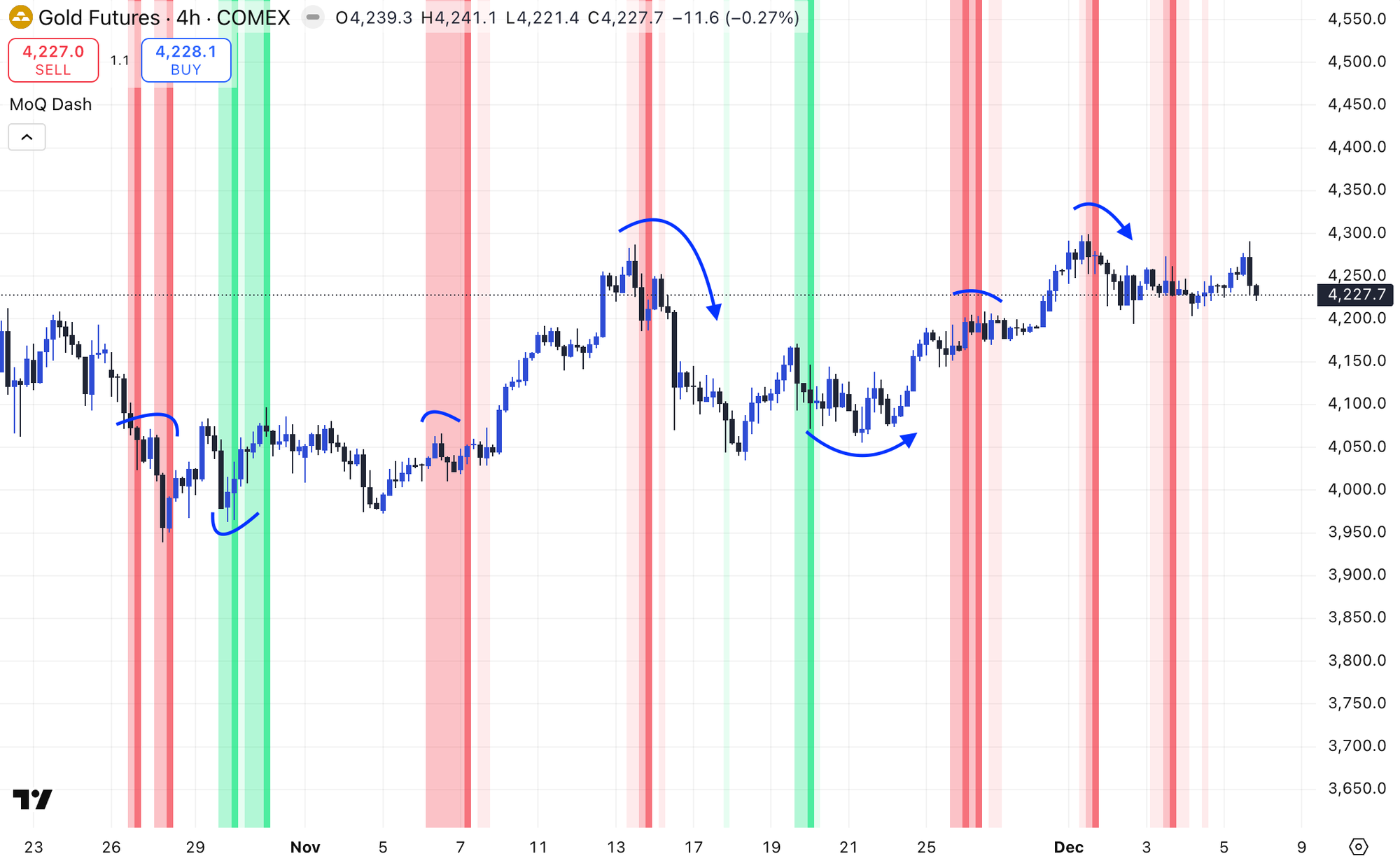

Setting DXY as the signal deliverer for trading GC Futures/XAUUSD or BTC:

Signals from the DXY on the Gold chart:

Signals from the DXY on the BTC chart:

Why this matters

Instead of guessing “Is the environment risk-on or risk-off right now?”, you get a live contextual backdrop on your own chart.

This is especially useful for equities, crypto, and macro pairs.

6. Layout, Theme, and Customization

Table Placement

You can position each table (Timeframe Table and Watchlist Table) anywhere on the right side of the chart:

- Top Right

- Middle Right

- Bottom Right

You can also show one table, both tables, or neither.

Theme

MomentumQ Dash supports Light Mode and Dark Mode.The theme setting controls:

- Text color

- Background color of table headers

- Contrast of Bull/Bear regime cells

This keeps tables readable no matter what chart style you use.

Symbol & Timeframe Configuration

- Timeframe Table → you choose up to 5 timeframes for the current symbol.

- Watchlist Table → you choose up to 5 symbols, and you choose one timeframe that applies to all of them.

This makes the dashboard fit both scalpers and swing traders:

- Scalper: 1m / 5m / 15m / 1h / 4h bias + SPX/NDX/VIX watchlist

- Swing: 1h / 4h / 1D / 1W + commodities, dollar, indices

7. How to Use MomentumQ Dash in Practice

Intraday trading

- Use the Timeframe Table to confirm that your entry timeframe is aligned with at least one higher timeframe in the same direction.

Example: You want a long. 15m shows PB or B and Trend=Bull, and 1h Trend is also Bull. - Check the Watchlist Table to confirm broader risk tone.

If indices are showing Sell and VIX is in risk-off, maybe don’t force a long.

Swing or macro bias

- Focus on higher timeframes (1h, 4h, 1D) in the Timeframe Table.

- Enable the Risk ON/OFF background and choose a macro driver (e.g. DXY or VIX).

- Use that to frame: “Am I trading with or against the environment?”

Pre-Signal watching

- Pay attention to PB (Pre-Buy) and PS (Pre-Sell).

- If PB starts stacking across multiple rows / assets, that may be the beginning of a rotation before the official Buy triggers.

“Last” timing check

- Look at the “Last” column.

- If you see

B (0)orPB (1), that’s current / fresh. - If you see

S (14), that’s old — don’t treat it as new.

8. What This Indicator Is (and Is Not)

It is:

- A consolidated, multi-timeframe, multi-asset market state dashboard.

- A context layer for directional bias, stretch, exhaustion, confirmation, and timing.

- A macro/risk overlay helper (via VIX or custom driver).

It is not:

- An auto-trading system.

- A guaranteed entry/exit generator.

- A profit guarantee.

MomentumQ Dash is meant to support discretion, not replace it.

9. Access Model

MomentumQ Dash is an invite-only script.

That means:

- You can favorite it.

- But you need explicit permission to use it.

To request access:

- Go to the MomentumQ profile on TradingView.

- Send a direct message.

- Include your TradingView username and a short note about how you intend to use the tool.

Only use paid/locked scripts from authors you trust and whose logic you understand. TradingView also recommends exploring open-source alternatives if you prefer fully transparent code.

10. Legal Disclaimer

Important Notice

MomentumQ Dash and this documentation are provided for educational and informational purposes only.

They do not provide financial advice, investment recommendations, or an offer to buy or sell any financial instrument.Trading involves risk. Past performance is not necessarily indicative of future results.

You are solely responsible for your own trading decisions. Consider consulting a licensed financial professional before acting on any analysis.MomentumQ Dash is licensed under the Mozilla Public License 2.0.

Redistribution or modification must comply with this license.

©MomentumQ. All rights reserved.